Overview

Recently, I’ve been contacted by one of our readers on why their inventory cost was wrong. This particular company utilizes standard cost and the inventory cost never matched their inventory G/L account. Learning about how they updated standard cost, it was very apparent what went wrong. It was how the user updated their standard cost.

Companies will periodically update their Standard Cost to reflect closer to what the cost of their items. The timing of this really depends on the company and the industry they’re in. I’ve seen companies revaluate their standard cost every month, some do it every quarter, some companies revaluate their standard cost every year.

Updating the standard cost is a must for every company, or else you will see big variances when you run your financials, which accountants and auditors will question every single time.

Update Standard Cost without Changing Existing Inventory on Hand

Depending on how your company wants to recalculate standard cost, you may not want it to change the inventory value on hand.

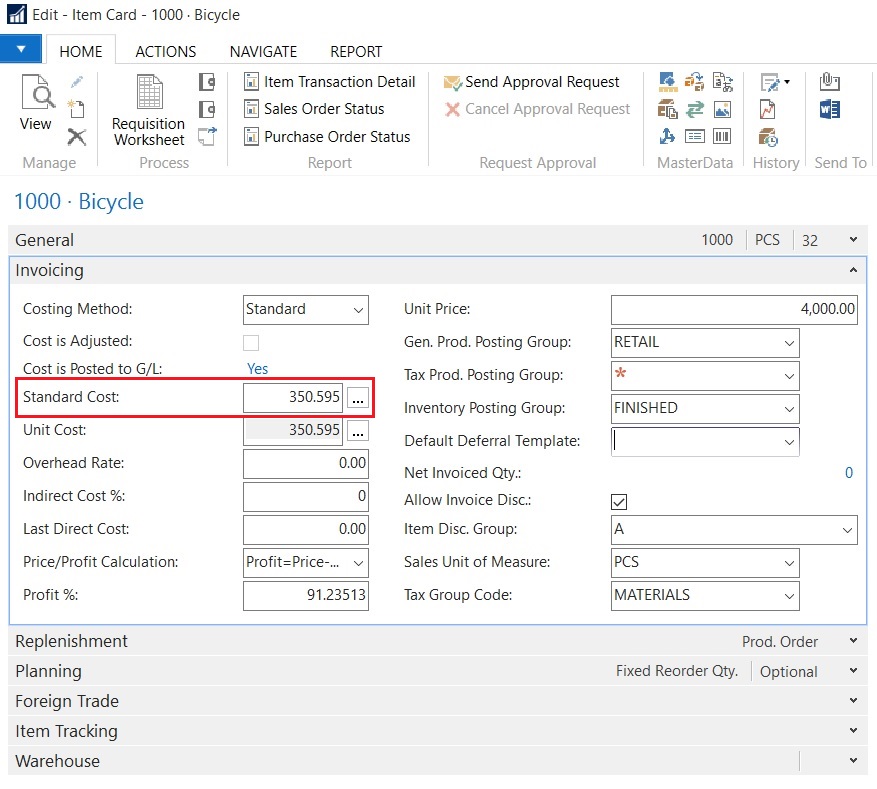

To do this, all you need to do is just updating the Standard Cost field on the Item Card of the Stockkeeping Unit Card is only part of the process.

The folks at Microsoft made it even convenient for you to do so:

All you need to do is just change the Standard Cost to whatever you like and you’re done. For manufacturing companies they may use the Calculate Standard Cost functionality.

What’s missing is you need to revaluate what you current have on hand to the new standard cost. Just updating the standard cost on the item card will only affect purchase or incoming items going forward. It will not affect historical standard cost values!

Where the Common Mistake Occurs

Not running Adjust Cost – Item Entries aside, the problem is not with the actual update of the standard cost, but the current inventory you have on hand.

Instead of running the Inventory Valuation report or the Inventory to G/L Reconcile report to get their inventory value, most accountants do the following:

- Grab the Standard Cost on the item card

- Multiply by the standard cost from step 1 by the quantity on hand

- Manually adjust the inventory G/L account

The 3rd step is what kills you. Making manual G/L entries will only make reconciliation between the item ledger and general ledger extremely tough and add a tremendous amount of (unless) work. In my career, I have not met a person that wants to do more work that is useless.

Update Standard Cost and Changing Existing Inventory on Hand

If you want to change your current inventory value on hand, you have to run the Revaluation Journal AFTER you update your standard cost.

Microsoft even published an article detailing the proper way of updating standard cost for your Dynamics NAV implementation. Click here for the article.

Conclusion

Properly used, the inventory function in NAV never goes wrong and will never require human intervention. What’s wrong is the information you feed it.

Hello,

We are using NAV2013R2, I am new at the company but not new to NAV.

The use standard costing, they have a g/l account uninvoiced receipts account which consist of posted purchase invoices. They are stating that this should be reconciled with actual purchase orders that are received not invoiced…what is causing this g/l to be so high in dollar amount?

The most likely reason is that the General Posting Setup and the Inventory Posting Setup are setup incorrectly. They’re probably pointing different transactions to the same G/L account.

Hello,

We have been using Standard Costing method for all our items and planning to add new items with Average costing method. Our BOMs are setup with this new item at average cost and all other components are using standard cost. Are there any specific information that we need to be aware of when BOM components of a product have standard and average costing?

Nope! Other than that the item being consumed will be utilizing the average cost (Unit Cost field) instead of the standard cost. NAV will do it’s job for you!

I have just ( last night ) revalued our standard cost using the Standard Cost Worksheet, and then posted the Reval worksheet that is generated as part of that process ( Nav 2009 Classic) and all is fine, but our Unit cost and standard cost are now out of sync ( and possibly may have been for some time ).

How do these two get aligned, as I understand that margin reports on Invoices are picking up the Unit Cost ( and so is incorrectly reporting margin at this time)

… and we are running auto Adjust Cost Entries twice a day 🙂

Richard

Hi Richard, if your Costing Method is set to Standard Cost, then the Unit Cost will be updated to the value on the Standard Cost field and it should be greyed out. This is how standard NAV 2009 works. Do you know if your VAR has customized this area?

Re: customised – yes, The unit Cost field is hidden from the Item card, and we have a whole raft of additional costs (custom fields) based around a Current cost scenario, so we can monitor standard vs Actual. I then Roll Up from current to standard when told to by finance.

It looks like that update may be broken here. I’ll get our VAR to check it through

thanks for the input Alex.

Richard

Hi Alex, I know I am replying to an old post, but I was hoping you would be able to guide me on how to correct a cost issue we have for a client.

The client decided to upgrade from NAV 2016 to Business Central and felt they did not want to run a full physical inventory count and would use what was in NAV 2016 as correct. Many of their items are set as STANDARD cost. What they had forgotten to do was import the Standard Cost value into the Item card before creating the item journal. They created the Item journal and saw that there were quantities and value from the import. Most items had multiple lines of entries with some as negative adjustments to certain locations.

Example: Item A had a positive adjustment to Location 1, 2, & 4, and a negative adjustment to location 3

The item journal was posted, and obviously, the cost did not carry over as the item card did not have a cost. Now the entries sit with no cost. We cannot run the revaluation journal as it won’t allow the negative adjusment line to revalue, and we cannot run the standard cost worksheet as it errors on the negative line. We cannot do revaluation for only the postive items, as there are thousands of entries. Some of these items have been sold, and now the cost of sales is zero as well.

I can’t use the Application worksheet to apply the negative adjustment to the positive one as they are on different locations.

How would you suggest I handle this and correct this for them? I am at a loss, and was directed to you via Mibuso.

Thank you for your time

Regards,

Malcolm

The same thing happened to one of the BC users that had called me a while back. Apparently, even experienced BC consultants don’t know you shouldn’t post negative inventory as beginning balance…

For those negative entries, you have to adjust them back to 0 quantity. BC will adjust the cost of those negative entries with the positive entries that you put in. Once the inventory quantities are 0, you can utilize the standard cost worksheet to revalue the inventory.